The year ends with a bang in the coffee industry. De'Longhi lays its cards on the table and forms a new "Coffee Hub" that brings La Marzocco, De'Longhi, and Eversys under one roof. This new corporate structure will be controlled by De'Longhi SpA (De'Longhi Group). ( An English version of the entire article can be found here. )

De'Longhi Industrial SA became the majority shareholder in 2021. La Marzocco CEO Guido Bernardinelli successfully threw a smokescreen at the time by pointing out that De'Longhi Industrial SA, and thus the De'Longhi family, had become a shareholder, but not the bustling coffee machine and household appliance company De'Longhi SpA. And the Delonghi Group itself also saw the need to make such a statement on February 8, 2021.

It's somewhat absurd that this statement largely put the issue off the table at the time. After all, De'Longhi Industrial SA, through Giuseppe De'Longhi, also controls the majority of the De'Longhi Group's shares.

For two years, hardly anyone in the industry talked about the fact that, at least in various structures under the name De'Longhi, the majority stake in La Marzocco was held. Today, all of this is irrelevant.

De'Longhi SpA has now confirmed that it is acquiring approximately 61.4% of La Marzocco's shares through a new subsidiary ( pdf ). A further approximately 26.6% of the shares are held by De'Longhi Industrial, and approximately 12% are held by minority shareholders of La Marzocco.

The new subsidiary will also include the Swiss fully automatic coffee machine manufacturer Eversys. The De'Longhi Group had already acquired Eversys in 2021 .

In retrospect, the 2021 communication seems hypocritical, as the De'Longhi Group was clearly already on a takeover course. That La Marzocco CEO Guido Bernardinelli wanted to protect his brand's cult status, however, is hardly surprising.

La Marzocco has become a cult barista brand around the world

The Florentine company La Marzocco, founded in 1927 by the Bambi brothers, has successfully built its reputation as a cult espresso machine manufacturer over the past 20 years. A key factor was its sponsorship of the World Barista Championship as a machine sponsor from 2000 to 2008, the resulting proximity to world-class baristas, and the high-quality manufacturing of the Florentine company.

" Handmade in Florence " has become a trademark, and I can personally confirm, after visiting the production facility in Scarperia, 30 km from Florence, that it is assembled, screwed together, and tested on site.

On the technological side, La Marzocco was responsible for several innovative leaps in espresso machine evolution. As early as 1970, a patent was filed for a double boiler that would allow independent heating of the brewing and steam boilers.

The combination of proximity to the barista community, the high quality of the machines, and local manufacturing in Italy made it easy for baristas around the world to identify with the La Marzocco brand. Local specialist partners and importers, such as those in Kialoa , Switzerland, also played a key role. It's no coincidence that La Marzocco Stradas, Lineas, and GB5s were also found in our cafés and academies.

This blend ensured that La Marzocco became the safe choice for espresso machines worldwide, whether in commercial cafés or at home. It's no exaggeration: according to L'Economia, 97% of global sales in 2020 were generated abroad. According to the De'Longhi Group, LM's sales in 2023 will amount to €240 million, with an adjusted EBITDA of €56.7 million. The consolidated sales of the new company, consisting of Eversys and La Marzocco, are forecast to reach €372 million in 2023, with an adjusted EBITDA of €87 million.

What will become of the cult and what will become of the quality?

The De'Longhi Group states that La Marzocco and Eversys will continue under current management. While they are talking about a new coffee hub, we interpret this as referring not to a local merger, but rather to a structural connection. Synergy effects, joint development, and the exchange of technologies could theoretically improve the espresso and coffee machines of all three brands. Cross-selling is also mentioned as a goal, with La Marzocco being closer to Eversys' fully automatic coffee machine than to De'Longhi's home espresso machine segment.

So, will we soon see a GS3 with a double-walled sieve à la De'Longhi Dedica? That would be less desirable than the Dedica's volumetric design in the Micra line.

It's difficult to predict where La Marzocco (and Eversys ) will go. Once again, short-term capital interests are the greatest threat to a good business idea. With all due confidence in LM's R&D team, some of whose leading figures I know personally, the question will be: will the focus of future development be on improving quality, or will cheaper components need to be integrated into the machines to improve margins?

How does the Scarperia team's identification with the brand change when the ownership structure becomes significantly more distant? And what impact does this have on the barista community's affinity with the brand? If I want to spend €5,000 on an espresso machine in the future and thereby connect with a company, would it be more likely to be a Xenia , a Decent , a Maro , or an ECM ?

What worries me, and which I already addressed in our test of the Linea Micra , is a problematic direction of development . With the marketing concept for the Micra, La Marzocco has consistently relied on online sales directly from Italy and bypassed its loyal specialist retailers in the various countries. In Germany, for example, the Micra can only be purchased through its subsidiary LM Deutschland. This company has set up a number of flagship stores in major cities, but is never as close to the home barista as specialist retailers. The result is very often customers who are overwhelmed with their machine. We know the consequences of these developments and see them every day in the comments under our videos and articles, as well as in our courses : questions, anger and disappointment because machine buyers are left alone and cannot get good coffee in their cups despite having a good espresso machine.

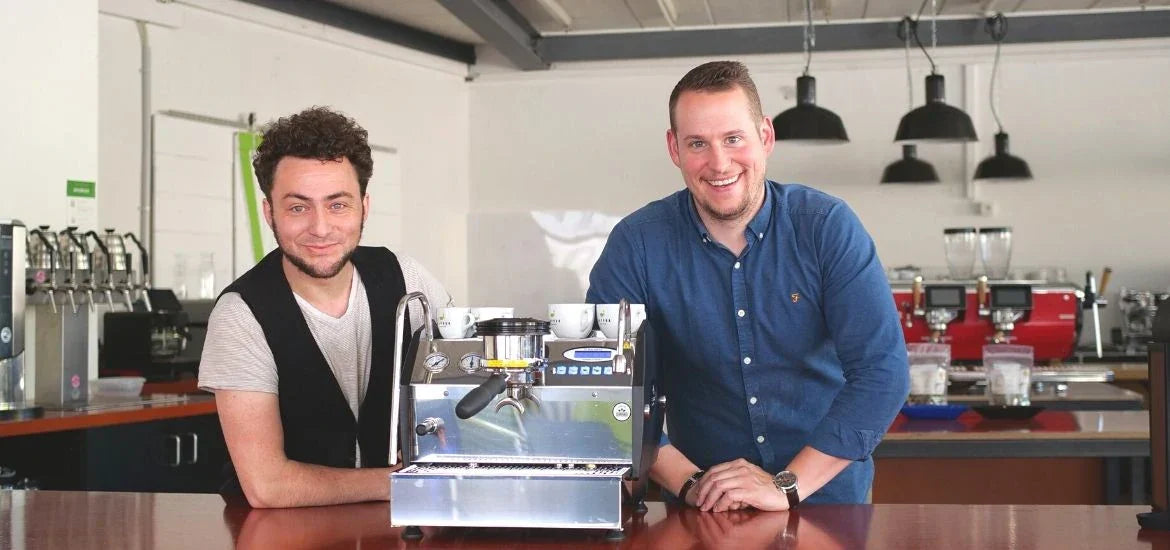

Assembly of Linea Minis, visit to La Marzocco, July 2019

The potential is great!

The new, now publicly traded alliance also presents many opportunities. La Marzocco, De'Longhi, and Eversys bring a wealth of expertise from diverse markets. They can all learn from each other theoretically. Eversys builds arguably the best fully automatic coffee machines for the hospitality industry. When the machines are properly adjusted, the espresso and coffee results are excellent and, in a blind tasting, almost indistinguishable from espresso from a portafilter. This means that during a sales discussion, the local machine dealer can confidently and without compromise offer the bakery or café the right machine for their intended use.

De'Longhi itself, with machines like the Dedica , demonstrates that decent espresso is possible even at a low price. La Marzocco, together with Marco Beverage Systems, filed a patent for a scale early on, which has now been released to the market. Eversys and De'Longhi will benefit from this expertise.

Last but not least, the new consortium can act as a counterpart in the market to other groups such as the growing Breville Group. Breville acquired Lelit (Gemme Italian Producers SRL) in 2022 , following Baratza's acquisition in 2020.

A final word on the new De'Longhi Coffee Hub before we wait and see what the new connection will actually bring us in the future.

I've already tested many products from both De'Longhi and La Marzocco. From the outside, I'd say there's a missing piece of the puzzle. The coffee hub is missing a grinder manufacturer. I wouldn't be surprised if another acquisition happens.

Let's be clear: The merger of these three companies is a significant milestone in the history of the coffee machine sector and will undoubtedly have an impact on the global coffee market.

![]()