"Just imagine," a speaker opened his presentation at a coffee conference a few years ago, "that the Chinese would discover coffee for themselves. Can you imagine the extent?" What sounded highly hypothetical and intangible to many a few years ago, caught the industry's attention and shook up the coffee world with a headline at the end of 2023: Since the end of last year, the teen nation of China has had more coffee shops than the previously undisputed leader in to-go shops, the USA. Let's take a look at the impact.

Which country has the most coffee shops?

The origin and groundbreaking moment for the modern coffee shop is often dated to 1966, when Peet's opened in Berkeley (San Francisco Bay Area), laying the foundation for the later giant Starbucks. Coffee, often regarded as a sobering aid for nations, also had a decisive impact on the work ethic of the population. In the 19th century, it replaced alcohol on the menu and, in Switzerland, became a companion to the equally new morning potato dishes.

Coffee To Go has become synonymous with the United States.

And so the coffee culture of the consuming West underwent further transformation. While in the 1860s, the first sale of roasted coffee in 500g bags, initiated by John Arbuckle, was celebrated, thus making life easier for housewives (as was stated in the numerous advertisements for the coffee bag), or in the first quarter of the 20th century, the invention of the Melitta filter, the espresso machine, and instant coffee was praised, by the 1980s, people wanted to be able to enjoy their coffee even more independently, even faster, and even more conveniently. Starbucks was born, a giant that continues to exert enormous influence on the entire coffee value chain. Since then, the USA has been the undisputed leader in the number of coffee shops. Coffee to go has become synonymous with the United States.

Is coffee drunk in China?

Back to my talk and the question "Can you imagine the scale?" The silence in the room suggested that few had considered it (or wanted to) up to that point, and that the question of scale wasn't really on anyone's mind. At the end of last year, the teenage nation of China itself gave us the answer to the question. In 2023, the Chinese drank 5 cups of coffee per person. Modest, it seems, when we compare it, for example, to the Americans, who consume 363 cups per person annually. A quick calculation shows us the following comparison:

If Chinese women were to drink just a quarter as much coffee as Americans in the future, they would already equalize per capita consumption and increase global consumption by almost 15%. The desire of Chinese generations Y and Z for the Western lifestyle is driving coffee consumption at a record pace. The following figures once again make us sit up and take notice. At the end of last year, there were almost 50,000 coffee shops in China. Of these 49,691 shops, 58% were scheduled to open in 2023! The Chinese chain Coti alone, for example, has opened 6,004 outlets. To put it bluntly: for the first time, the USA has been dethroned as the coffee shop leader. And this is due to the birthplace of tea, which now has more coffee shops than the birthplace of coffee shops themselves.

Is coffee grown in China?

Well, yes. Tea and coffee thrive in similar growing conditions. Both require sufficient water, sufficient warmth, and a similar soil composition. Coffee, however, is much more susceptible to cold temperatures. These conditions for successful cultivation can be found in the southwest of China, which accounts for a third of global tea production. 95% of the country's coffee grows in the Yunnan region. Hainan (Iceland) and Fujian play a role in the Robusta market. An impressive 60% of the coffee produced in Yunnan comes from a single region, Pu'er.

At the end of February 2024, Sucafina, a Swiss green coffee trader, opened the largest wet mill in Yunnan. It is also the largest that Sucafina operates worldwide. The state-of-the-art wet mill is equipped with solar water heaters and can, among other things, process over 15 million cherries in an hour. With 4.2 million 60-kg bags of green coffee, China, the teenage nation, is the ninth-largest coffee producer in the world. These are further impressive figures in a country where coffee was barely appreciated until three or four years ago. China's export volume of green coffee roughly covers Swiss consumption.

What impact does this have on the economy?

The growing appetite for coffee among Chinese people has already led to groundbreaking announcements. For example, the Australian Open recently announced that Luckin Coffee would become its official coffee partner in China and Southeast Asia. As the largest Chinese chain, Luckin Coffee has had more shops since 2017 than Starbucks, the previously dominant player in the coffee shop market.

Luckin Coffee displaces Lavazza as partner of the Australian Open

And this despite Lavazza having been the partner of all four Grand Slam tournaments since 2015. The fact that the Australian Open chose Luckin Coffee as its partner is likely to raise several questions for some. The chain generated numerous negative headlines in 2019/20 surrounding fraud and insolvency. The COO had falsified sales figures worth millions, which ultimately led to the company's delisting from the stock exchange. Despite the fraud scandals and insolvency, Luckin Coffee has fought its way back. Through stricter internal controls, the company hopes to regain the trust of investors and customers. Apparently convincing enough for the organizers of the Grand Slam tournament.

A few days ago, we received news that Luckin Coffee had entered into a deal with Brazil for 120,000 tons of coffee with an estimated value of $500 million. This represents approximately 5% of Brazil's green coffee production for the 2024/25 harvest year. By comparison, in 2023, Brazil exported $280 million worth of coffee to China—to the entire country, not just to one chain. In 2023, Luckin Coffee opened 16.5 coffee shops per day. That's something to let sink in.

And now?

The younger generations in the Asian market have a tremendous appetite for coffee. Not just for hot, but especially for cold beverages. Almost daily, we receive coffee news from the Middle Kingdom and throughout Asia. The Philippines and Malaysia are experimenting with the Liberica and Excelsa varieties, Vietnam is producing specialty Arabica, and India and China are refining their post-harvest processes and bringing coffees with high SCA scores to market. Together, these people are driving coffee consumption upwards with diverse power. Top quality is sought after and appreciated, and, as a prestige item, is paid for accordingly. A favorite variety is Geisha, which scores particularly well for its tea-like character and delicate, floral notes.

The desire for coffee among the younger generations in the Asian market is enormous.

Coffee preparation preferences have also changed. Cappuccino has become the most popular beverage, replacing the previously highly valued instant coffee. The increased appetite for milk-based beverages brings with it another interesting statistic. In 1949, there were 120,000 dairy cows. Today, there are 13 million.

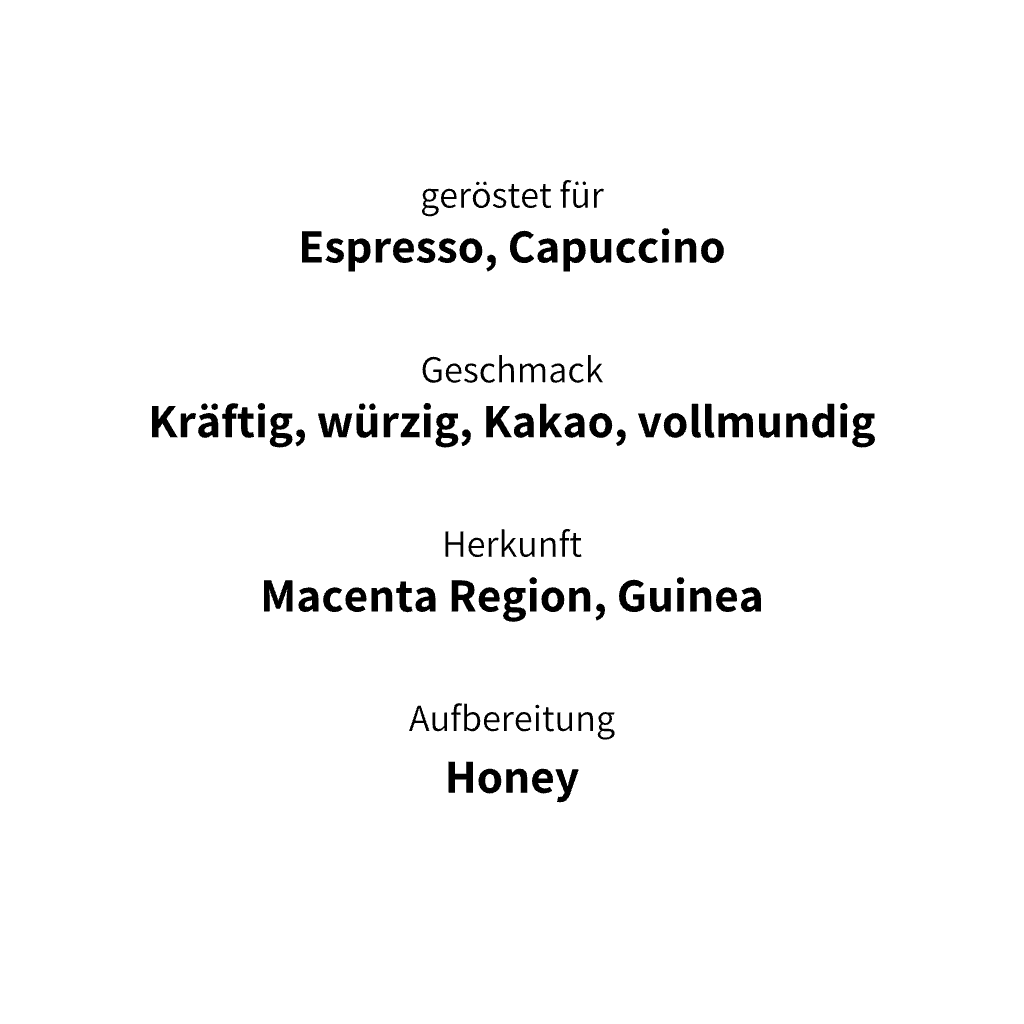

Their consumer behavior will also be felt in our latitudes. Especially in tourist regions, where we will increasingly welcome guests from Asia to their cafés. Those who offer coffees without overwhelming bitterness and without aromas of burnt tires and toast will be able to win over these curious and open-minded visitors.

Because with them, demand in the restaurant and hotel industries will likely change: Not only will more coffee be needed, but also better quality and other flavors tailored to the Asian palate. As the saying goes, you do the math.