At the beginning of February 2022, the price of coffee was higher than it had been eleven years ago. What were the reasons for this? Who benefits from it and who doesn't? And will the price of coffee continue to rise? We take stock.

About half a year ago, roasters and retailers began raising prices for roasted coffee. These price increases are actually price adjustments , as the raw material, green coffee in particular, has become significantly more expensive. There are several reasons for this, but it all began with the COVID-19 pandemic.

Coffee price increase - it started with Covid-19

Remember the delivery delays at the beginning of the pandemic? We all suddenly had to wait weeks for a shipment to arrive, instead of just a few days. This hit suppliers hardest first, and ultimately private customers. Those weeks turned into months, and just a year into the pandemic, the logistics world was in the deepest chaos it had ever seen.

I blogged about this here : it's about force majeure, the force majeure - once-in-a-century events that never actually happen, and when they do, they shake everything up.

For example, we're still waiting for a green coffee shipment that should have arrived three months ago. Other shipments have also been massively delayed or even canceled altogether.

It all began with too many ships in one place and too few in another shortly after the first lockdowns. This led to traffic jams at the world's largest ports – both on the water and on land for trucks. Within a very short time, an imbalance developed that logistics experts had never seen before.

But why has coffee become so much more expensive?

Reason 1: logistics costs

Against this backdrop, the price of a freight container rose massively. Anyone wanting to transport goods had to pay more and more.

The Global Container Index from https://fbx.freightos.com/ clearly shows how freight rates for a shipping container have developed. A tenfold increase in costs is no longer uncommon. For the same container and the same route, mind you.

A 20-foot container transport from Peru to Europe cost approximately USD 1,200 just over two years ago – today, it costs almost ten times as much. This is particularly beneficial for the major shipping companies. Maersk's share price, for example, has risen by 200% in the last two years.

A well-oiled gear system was severely disrupted.

A cargo ship can accommodate up to 20,000 containers. If just ten ships are delayed, there's a global shortage of 200,000 shipping containers. That's enough to destabilize a delicately balanced system. And that's what happened. The Port of Los Angeles experienced the largest offshore traffic jam in the history of American shipping .

Reason 2: the frost in Brazil

And then, on July 1, 2021, frost hit large parts of Minas Gerais. In one night, temperatures dropped to -1.2°C, enough to destroy entire areas of crops. Within two weeks, the price of coffee rose again by a good 60 cents per pound (lb).

Screenshot showing the price development in July 2021.

However, no one yet knew the exact extent of the damage. Now that the harvest in Brazil is slowly beginning, it remains to be seen whether the estimates of up to 30% crop failure were accurate, or better yet, justified . Justified because coffee is an extremely volatile market, shaped by perceptive forces. When there are signs of a crop failure, the first estimates come in, speculation ensues on the futures exchange, and prices rise rapidly – although none of this is yet definitive information, but merely speculation.

Only now is it slowly becoming clear that the total damage is significantly lower than expected. However, in some areas, producers were hit hard, and the majority of their harvest simply froze to death.

The coffee exchange reference price, the so-called C-Price, thus rose massively again within a very short period of time. Even then, or shortly before, the first coffee roasters, including Tchibo , had raised their prices. It became apparent how trading houses and roasters had become accustomed to extremely low price levels, so they raised their selling prices for roasted coffee as soon as the first price increase occurred in June 2021. A second increase followed in February 2022 .

Since the price of coffee is subject to a classic supply and demand dynamic, the C-price increased. All other coffees with so-called differentials are also based on the C-price. A differential is a premium (or discount) on the C-price, which is determined based on quality and, in this case, also on supply and demand.

For example, there is a good market for washed green coffee from Guatemala; the coffees are in demand, and quantities are limited. This is reflected in the differential, so that this coffee always sells for about 30 cents/lb above the C-price.

So even if a coffee producer in Malaysia has absolutely nothing in common with a producer in Brazil, they are still compared through the C-Price. Locally, the differential also comes into play, rewarding or penalizing the coffee somewhat.

Reason 3: everything is out of joint

Uncertainty is anathema to speculators. Speculation in the coffee market further amplifies the upward or downward momentum. And speculation increases especially when there is uncertainty, and this has been increasing for more than two years now.

No matter how far away a coffee farm is from the action on the New York Stock Exchange, the effects are immediately noticeable.

In 2021, Colombia experienced riots, and ports were closed for weeks. Trucker strikes occurred in Brazil and Vietnam, and logistics were severely disrupted domestically. There is war in northern Ethiopia, La Niña in Indonesia, and Central America has been far too dry for a long time.

The only constant about coffee is its inconsistency.

These uncertainties have always existed in the coffee industry, but recently they have been perceived with greater sensitivity, leading to increased unrest and speculation. This has given coffee prices a further impetus to surge.

Reason 4: Covid-19 in the coffee regions

COVID itself has struck hard in many coffee-growing regions. We mustn't forget, though, that the vast majority of coffee-growing countries are developing countries. Basic medical care is often slow, poorly distributed, or even very radical.

We heard various anecdotes from our partner producers:

- Pickers stay at home because they fear infection

- This led to less internal migration of pickers who would have worked as seasonal workers in the coffee regions

So, pickers' wages had to be raised just to find someone willing to harvest coffee cherries. But when prices are high, pickers don't have to make any effort to pick good quality, unless they're paid even more. And that's the case with specialty coffee – all coffee is getting more expensive, but specialty coffee even more so.

If you want good quality, you currently have to pay significantly more than before.

Benni Distl from Rancho San Felipe in Mexico told me:

I paid twice as much as last year, but the pickers still barely show up. The same pay for half the work, some say.

The Homo Oeconomicus approach may work for some people here, but not in other parts of the world.

Reason 5: higher interest rates for coffee farms

And then, due to all this uncertainty, interest rates on loans also became more expensive. Loans that coffee producers need long before the harvest to continually invest in new plants, cover fixed costs, and pay staff. Coffee farms typically earn money once a year—when the coffee is sold.

But cash is constantly needed; after all, a coffee farm is essentially a business that has to operate like any other. However, interest rates for this type of business have risen dramatically. In Peru, Mark Bolliger explains , interest rates rose from 15% to 21% – within just a few months.

Reason 6: higher costs for fertilizer, diesel and life (inflation)

Russia is the world's largest exporter of fertilizers, while Brazil is the largest consumer of these fertilizers. Brazil is also the world's largest coffee producer, accounting for approximately 33% of the world's total. Coffee producers also use Russian fertilizers, and domestic prices for Brazilian coffee have risen again in recent weeks. And because price changes in Brazil also have global repercussions, this is reflected in other coffee-producing countries.

Accurate accounting is important for everyone these days. However, many coffee producers have little insight into their production costs.

In addition to fertilizer, fuel prices have also increased significantly, which we are also feeling here. Fuel is needed on farms, but shipping is particularly affected , which continues to keep logistics costs high.

And then the whole world is feeling the effects of inflation. Just this week, I paid two francs more than usual for a falafel – oil has become more expensive, as has bread. The latter, in particular, will likely become even more expensive, since Ukraine and Russia are also among the largest exporters of grain .

No stock market coffee, and still more expensive

So, several reasons and effects have driven the price of green coffee upwards. Even though we don't base our pricing on the market price, it still influences our pricing. The prices for our green coffee are usually set by the producers themselves. In addition, there are the costs of processing, export, transport, pre-financing, insurance, and storage.

Producers are influenced by all of the reasons mentioned above. The C-price rose sharply in a short space of time last July because two nights of frost in Brazil threatened to jeopardize a substantial portion of the harvest. Producers are also aware of these developments and are "slowing down" their sales, meaning they are not yet selling the coffee that has already been harvested, or the coffee that will soon be harvested. They are waiting, as the coffee price could still rise further, and they would then earn more from selling the cherries.

Coffee is currently being hoarded by producers before being resold.

Coffee producers have always been price takers, not price makers, as Raphael Studer has highlighted again in this podcast .

I take what the market gives me.

This is how producers have been conditioned for decades. It's only logical that this mechanism continues to exist now, even if it's already working in favor of producers.

Not everyone earns more now

And yet, just because prices are higher doesn't mean everyone automatically earns more. The reasons mentioned above show that everything has become more expensive, not just green coffee. Some producers are likely to benefit nonetheless, especially those with very efficient operations.

In Dipilto, northern Nicaragua, however, a different picture emerges, which is not uncommon. Many pickers are leaving the region, farm work is becoming less attractive, and life is becoming more expensive. Farms are desperately looking for workers and are having to pay day laborers wages that would have been unimaginable two years ago.

The long-term effects of this recent price rally on coffee production still need to be analyzed to get a more accurate picture of winners and losers.

But who earns more now?

Shipping companies certainly do. The bottleneck is evident in logistics. There is no alternative to sea transport—at least not a faster or cheaper one. Transport by sailing ships will increase in the future, but it will be a long time before this share becomes substantial.

Trading houses, roasters, retailers, cafés—all players at the end of the coffee chain initially forego some margin, but now have to adjust their prices to cover their costs. The additional cost is passed on to end consumers, making coffee more expensive.

Nobody knows how long the price will stay this high. What we do know, however, is that we want to make our green coffee supply chains and our collaboration with coffee producers even more self-sufficient. Our goal is to ensure that, ideally, geopolitical events no longer influence the way we would like to see coffee production in the future. We will have more to report on this in due course.

How much more expensive will our coffees become?

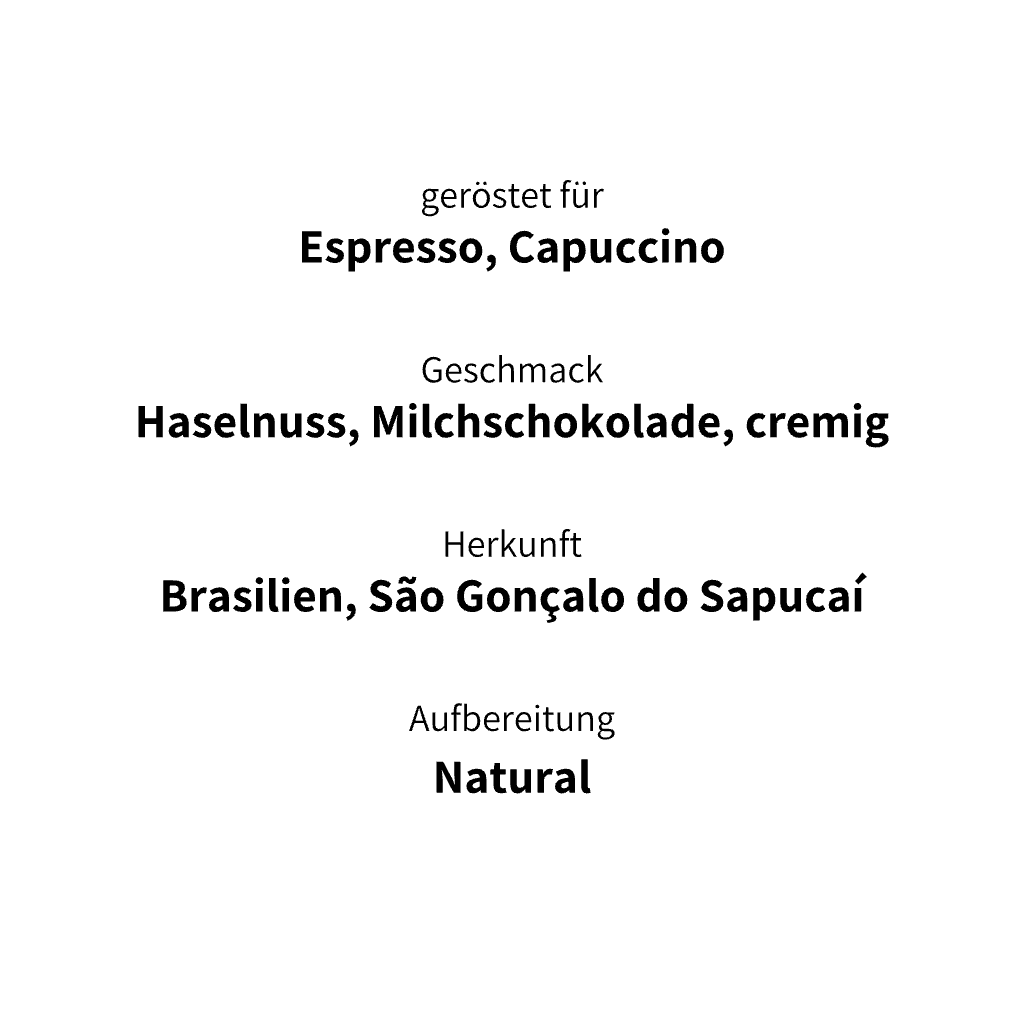

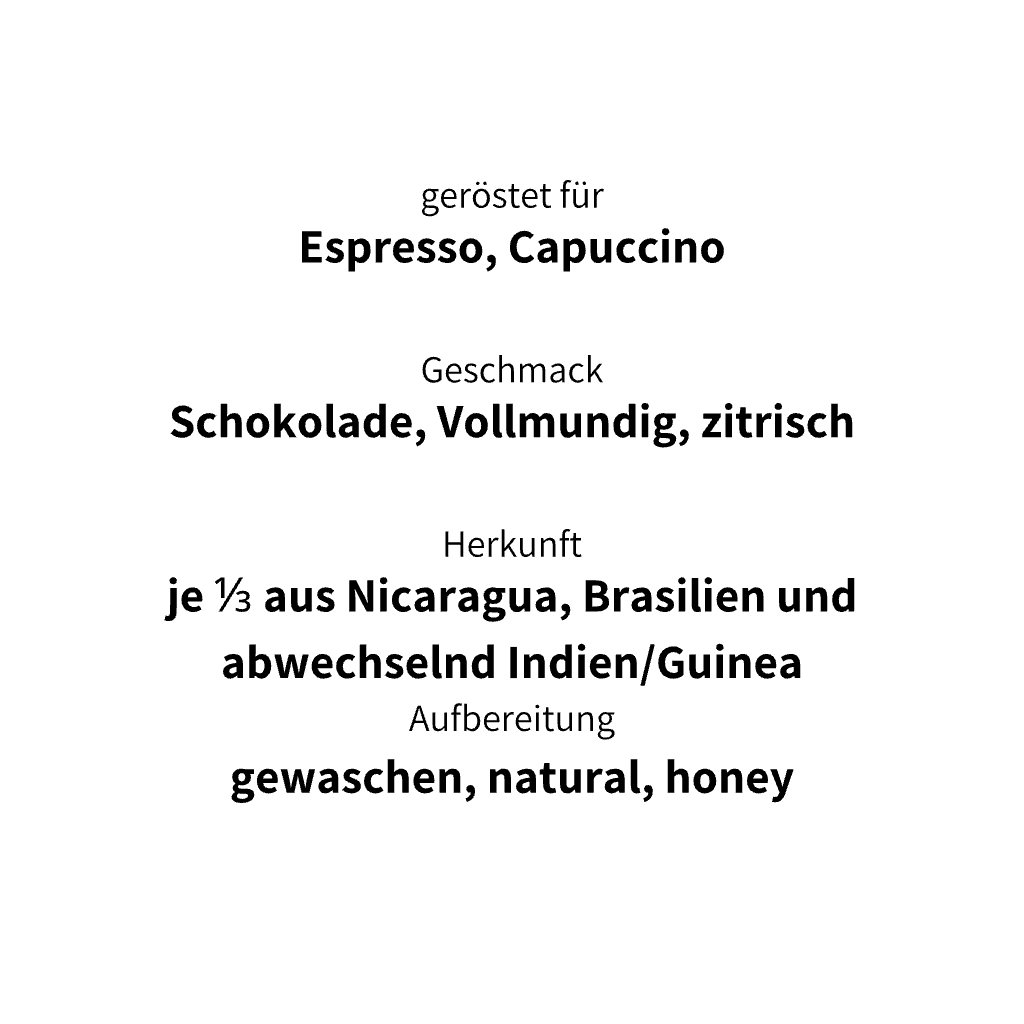

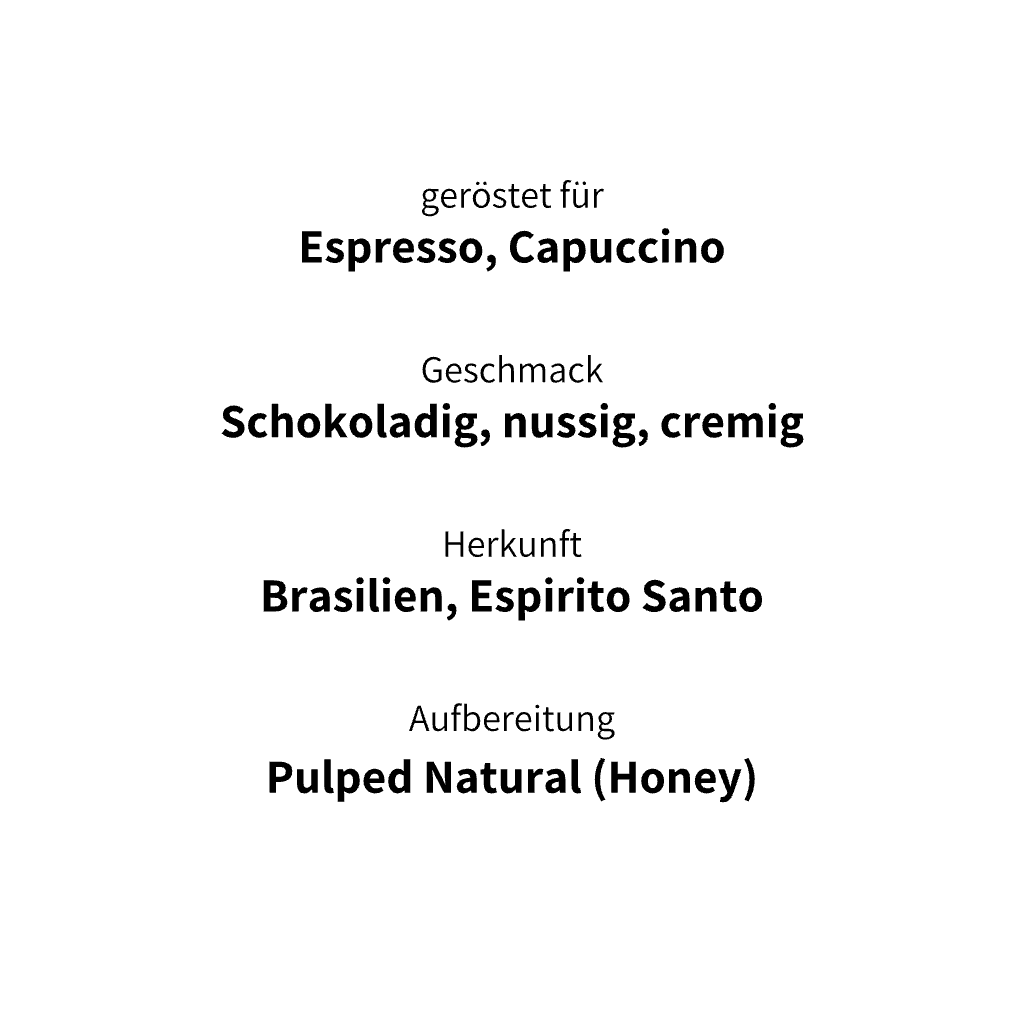

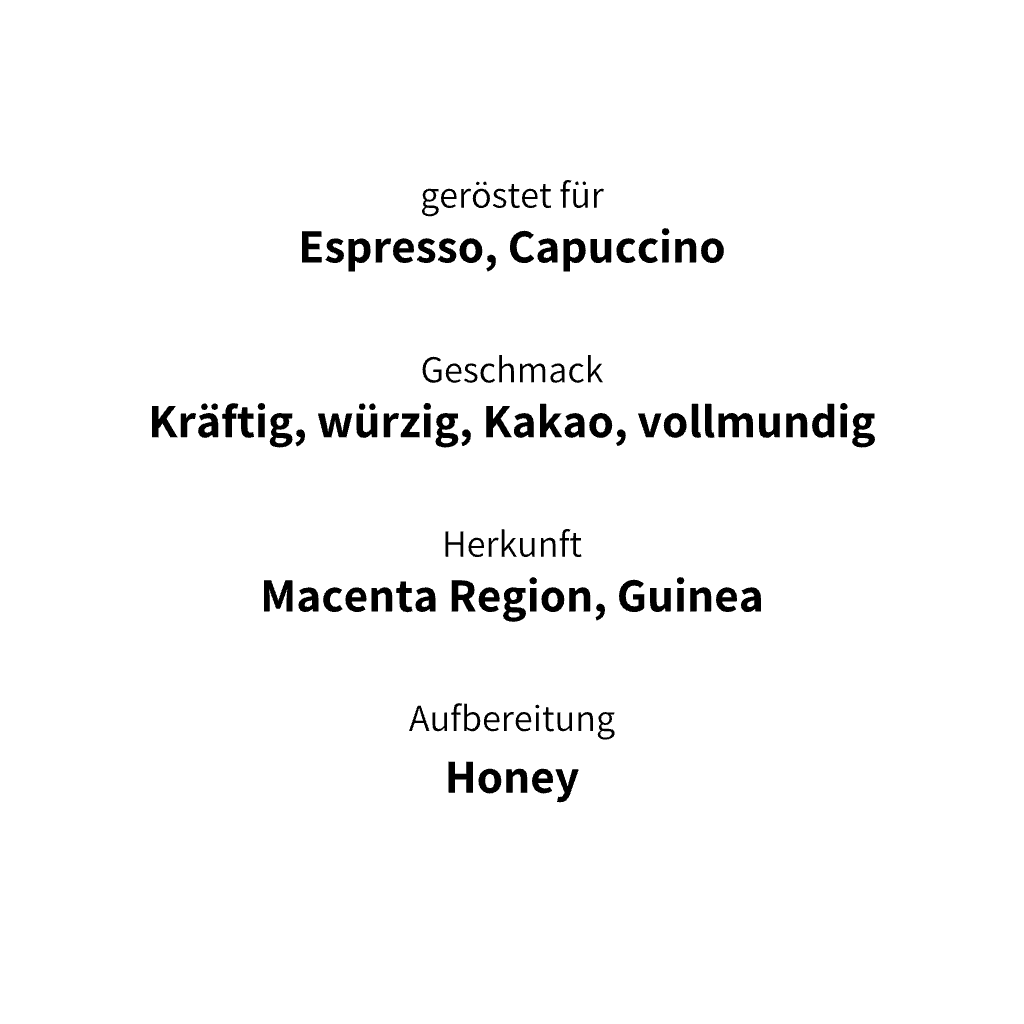

We are making moderate price adjustments to four of our coffees as of May 1, 2022: Henrique, Flhor, Flaneur, and Dreispitz . Even though the green coffee price from the APAS cooperative has almost doubled, we are keeping APAS at its current price level. The coffee is important to us, it's important to you, and we are currently intensively developing our partnership with APAS – more on that later this year. We want to be a reliable partner, purchase the promised quantities, and keep the coffee attractive to many.

The Management Summary as a postcard

A postcard with concise information on why coffee prices are rising is now available in our cafés, shop, and academy. It was important to us to fully understand the current situation and summarize it for you here. You can find the text of the card here.

The past two years have also severely shaken the coffee industry. The COVID-19 lockdowns severely disrupted the well-oiled machinery of global logistics, and this continues to this day. Delays and massively increased transport costs are the consequences. The pandemic itself continues to leave its mark in many coffee-producing countries – fewer pickers can travel freely, there is an acute shortage of harvest workers, and the sometimes poorly functioning health systems forced many people to stay at home. Life became more expensive during the pandemic, inflation rose, and in July 2021, frost hit the southern coffee regions of Brazil. Two nights of frost were enough to wipe out perhaps as much as 30% of the upcoming harvest. The price on the exchange continued to rise massively overnight. Although we don't use the coffee exchange for pricing with producers, we are affected: if the global exchange price rises, higher local prices can be achieved. Producers base their decisions on the so-called C-price and wait to sell coffee cherries to cooperatives, for example, which forces them to raise the purchase price. Even for moderate quality, the price is currently about twice as high as it was two years ago. And that hardly motivates workers to pick more precisely. Anyone expecting specialty quality has to offer even more, because the base price is so high. Rising raw material prices, including for fertilizer, are doing the rest, keeping prices very high. And who benefits from this? Above all, the shipping companies, which are currently in high demand. Some producers are also able to profit, after the coffee price had barely covered production costs or not at all over the past ten years. We ourselves have been able to gain efficiency with the new roasting facility, which allows us to adjust roasted coffee prices only slightly.