Coffee roasters in Germany are subject to coffee tax. €2.19 per kilogram of roasted coffee goes to the government. When does the coffee tax become payable, how does it work, and how can roasters manage it easily and practically? A brief guide for roasters, compiled by the Black Hen roastery in Saarbrücken.

Coffee roasters have been required to pay the coffee tax since 1948. Until further notice, roasters must pay €2.19 per kilogram of roasted coffee to the government. There is no minimum or de minimis threshold. Every gram counts – the tax is due when the roasted coffee enters the economic cycle. Efforts by the Federal Ministry for Economic Cooperation and Development (BMZ) and Fairtrade to abolish the coffee tax on fairly traded coffee came to nothing in 2021 .

Unlike a tax return, which requires submitting documents to the tax authorities, the coffee tax is collected from coffee roasters by the Federal Customs Administration. This physical inspection recalls the origins of the coffee tax in the 18th century , when so-called coffee sniffers searched for coffee. The Tegernseer Kaffeerösterei has written an engaging blog about it.

What should a coffee roaster do now?

Our friends from Black Hen in Saarbrücken have summarized the process and documented it with pictures.

Guide for coffee roasters

Author: Kolja Conrad

When establishing a roastery, a so-called "tax warehouse" must be applied for at the responsible main customs office. A distinction is made between whether a roastery will tax the roasted coffee directly during production (the most common case) or only upon sale.

This is especially true if you plan to sell at least part of your roasted coffee to other (European) countries, where this coffee tax is naturally not levied. A "proper" tax warehouse must be set up for this purpose, which is inaccessible to unauthorized persons, but accessible to customs officials at any time for inspection purposes. The less complex option, therefore, is to tax the coffee immediately after the roasting process.

Step 1: Weigh the green coffee

The green coffee is weighed before roasting, and the weight is recorded batch by batch in a so-called "roasting log." Since we work with defined batch sizes and this information is also relevant for inventory management, this doesn't require any additional effort.

Step 2: Weigh the roasted coffee

Following the roasting process, the roasted coffee is weighed, and the roasting loss is determined. This usually occurs when the coffee is poured from the stoner into larger buckets. These values are also recorded in the roasting log.

Step 3: Add roasting book

The amount of roasted coffee produced on a roasting day and the amount of green coffee used for this purpose are recorded summarily in the roasting book.

Step 4: The inventory book

At the end of each month, the quantities of roasted coffee produced on all roasting days are added together and recorded in the “stock book” along with the batch numbers.

In addition, this quantity must be submitted to the main customs office using form 1807, "Monthly Tax Declaration for Coffee and/or Coffee-Containing Goods." A coffee tax of €2.19 per kilogram of roasted coffee is due, which must be paid by the 10th of the following month.

Step 5: Coffee inventory registration / Form 1830

In principle, this is where only the final monthly quantities are summarized and any discrepancies are addressed. This "stocktaking" is considered a type of inventory, which must be reported to customs inspectors 14 days in advance – even if it usually involves nothing more than printing out a form. This stock report only needs to be submitted once a year, at the end of the year.

Notes on the procedure

Roasted coffee that has already been taxed and is not sold for whatever reason must be collected and destroyed under the supervision of a customs officer to reclaim the tax paid. To do so, an "Application for Relief from Coffee Tax" must be submitted in the monthly coffee tax return.

Each main customs office can decide in what form the roasting book is kept: analogue, digital, as an Excel spreadsheet, Cropster extracts, etc.

In Saarland, the roasting book must be kept manually because this procedure is supposedly forgery-proof.

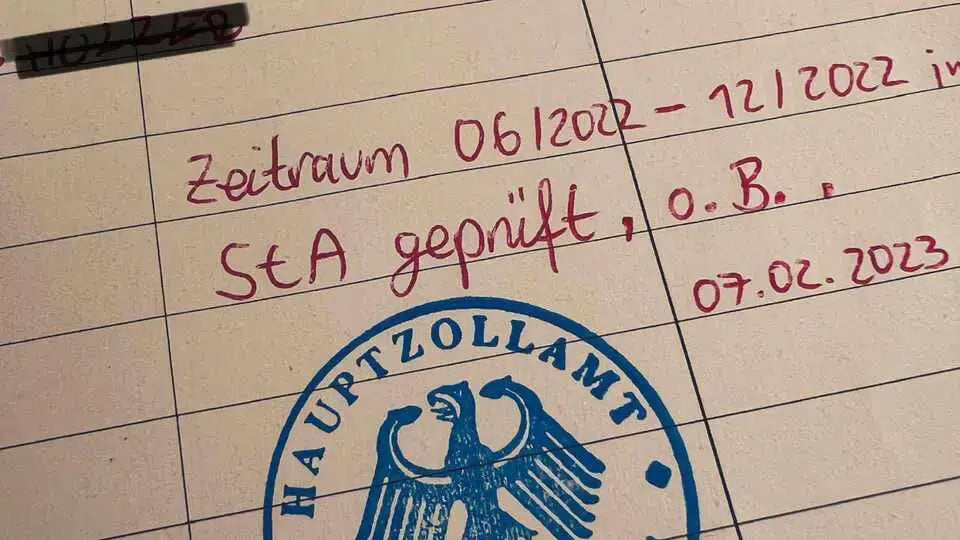

Customs officials can inspect roasting and inventory records at any time, both announced and unannounced. All amounts are recorded and checked to determine whether the stated roasting loss is realistic or not.

Failure to submit the monthly coffee tax declaration or inventory (or prior notification) may result in fines of up to €8,000.00.

There's no brochure or training course that informs future tax warehouse keepers about their duties and responsibilities. Here, you have to rely on the responsible customs officers to explain everything.

In detail, however, it seems that very few have contact with roasters during their training or career and usually do not even know exactly what needs to be done and how (and refer to the “Practical Handbook on Coffee Tax” by Uwe Mühlenhardt and Johannes Hielscher).

Notes on the coffee tax itself

The otherwise very strict declaration requirements for food products are sometimes very lax for coffee (and tea) products (what exactly is in the package? Where does the coffee come from?). Supposedly (!) this is because the coffee industry lobby is unwilling to legally challenge the completely outdated coffee tax in exchange for a lax declaration requirement. High tax revenues in exchange for lax declaration requirements, so to speak – but one would have to verify whether this is true.

I have mixed feelings about the effort mentioned at the beginning to waive the coffee tax on fair trade coffee . Fundamentally, I find it quite outrageous that the German federal government receives almost as much money for 1 kg of roasted coffee as a farmer who grew the coffee (in the lower price segment) – only to (to put it simply) send a portion of it back to the global South as development aid.

Easing the burden on fair trade coffee would reduce price pressure and actually ensure that more coffee comes onto the market. On the other hand, it would make it much more lucrative for the industry to circumvent and cheat fair trade models.

For questions about the coffee tax

Black Hen: Contact

German Coffee Association: Contact